Key Takeaways from the Updated Manual

We understand that preparing for the next reporting season can be challenging. That's why we've summarised the key takeaways from the updated manual to help make the experience smoother and more efficient for our Tagger users.

1. Use of elements available in the IFRS Taxonomy that were not yet included in the ESEF taxonomy (Guidance 1.2.2)

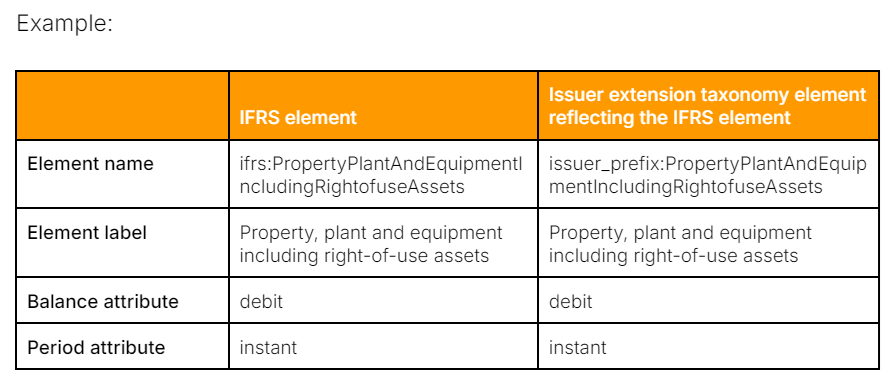

The main change in this guidance is that years have been removed from the process to keep it generic. Therefore, if an issuer finds that an element in the IFRS Taxonomy corresponds to a disclosure in its IFRS financial statements but is not yet included in the ESEF taxonomy, they can define an extension taxonomy element with the appropriate name, label, and XBRL characteristics (see example below). Once a new element is included in the ESEF core taxonomy, issuers should adopt it and also use it to tag prior period comparatives in the current report.

2. Anchoring of extension elements to elements in the ESEF taxonomy that are wider in scope or meaning (Guidance 1.4.1)

Extension taxonomy elements in IFRS consolidated financial statements must be anchored to the ESEF taxonomy, except for subtotals. For example, if an issuer separates capital increases in kind and in cash, these should be anchored to the broader "issue of equity" element to avoid duplicates and ensure comparability. The update highlights that issuers should anchor their extension elements to ESEF core taxonomy elements sharing the same data type. For example, if an issuer creates an extension element of monetaryItemType, such element should only be tagged to corresponding ESEF core taxonomy element of monetaryItemType (and not e.g. stringItemType).

3. Formatting of the period element in the context of the Inline XBRL document (Guidance 2.1.2)

The update in this guidance relates to dates for period type instant. ESMA recommends using 202(X-1)-12-31 instead of 202(X)-01-01.

For example, Equity at the beginning of the period for the current year (2024) should read 2023-12-31 instead of 2024-01-01.

4. Tagging of dashes or empty fields (Guidance 2.2.5)

Issuers are required to mark up all numbers in a declared currency in their IFRS consolidated primary financial statements. To ensure the machine-readable version aligns with the human-readable version issuers should consider the following guidance from ESMA:

- cells understood as zero (example: “-”, “n/a” or “ “) should be transformed to "0" using appropriate transformation functions.

- values rounded below the scale should show as zero.

- If nil values are relevant, issuers should explicitly specify them without transformation, i.e. there is no need to tag these.

- comparatives should not have empty cells in one period if they have values in another period.

5. Technical construction of a block tag (Guidance 2.2.7)

ESMA is in this update advising issuers to follow specific guidelines to ensure the tagged information closely matches the human-readable report:

Therefore, all textblock tags need to have the escape attribute set to True, while String tags need to be set to False.

6. Naming convention for report packages, report files, and stand-alone XHTML documents (Guidance 2.6.3 & 4.1.5)

ESMA has updated its guidance to include version numbers in the naming conventions for both report packages and stand-alone XHTML documents. The recommended format is {base}-{date}-{version}-{lang}. For report packages, the extension is .xbri, and for XHTML documents, it is .xhtml or .html. The first submission should use version number 0, with each subsequent submission to the OAM increasing the version by one.

- {base}: Issuer's LEI, name, or abbreviation (up to 20 characters).

- {date}: Reporting period end date in YYYY-MM-DD format.

- {version}: Submission or document version.

- {lang}: Report language in ISO 639-1 format.

Issuers should follow specific national naming conventions provided by Officially Appointed Mechanisms or National Competent Authorities, if different from ESMA's guidance.

7. Documenting arithmetical relationships in the calculation linkbase (Guidance 3.4.1)

The XBRL 1.1 Calculation specification offers improvements, including better handling of summation items and rounding issues. ESMA recommends that software firms implement this which will help avoid false positives in validation reports.

8. Documenting arithmetical relationships in the presentation linkbase (Guidance 3.4.8)

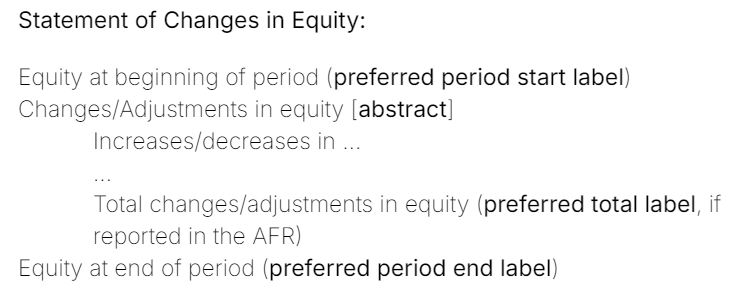

Some Primary Financial Statements include cross-period arithmetic relationships that can't be captured by the calculation linkbase. One example is the statement of changes in equity, which involves reconciling balances over different periods.

To handle these cross-period and cross-dimension relationships, the presentation linkbase should be used. This updated guidance shares examples such as the following:

Presentation linkbases should mimic calculation linkbase structures, defining parent-child relationships where lower-level elements contribute to upper-level elements.

For more detailed information, you can access the updated manual here.

Let's make this reporting season a success!

Would you like to receive this type of updates and information directly in your inbox?

Sign up to our CtrlPrint Highlights by following this link.

Don't forget to invite your colleagues and others, whom you think would benefit from this content.

Thank you for reading this CtrlPrint ESEF Highlights!